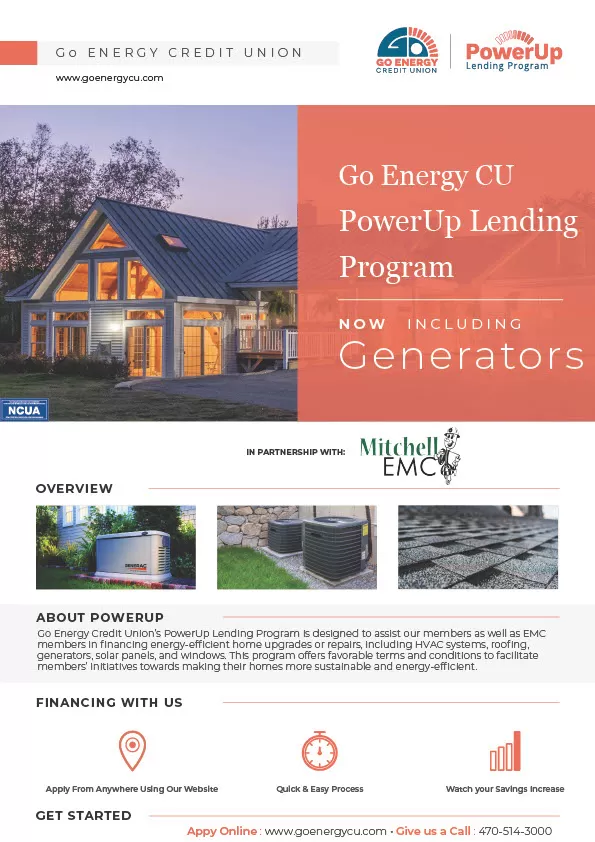

Power Up Lending Program

Go Energy Credit Union’s PowerUp Lending Program is designed to assist our members as well as EMC members in financing energy-efficient home upgrades or repairs, including HVAC systems, roofing, generators, solar panels, and windows. This program offers favorable terms and conditions to facilitate members’ initiatives toward making their homes more sustainable and energy-efficient.

Questions?

For details about the PowerUp Lending Program, contact Go Energy Credit Union:

Apply: goenergyfinancial.com

Phone: 470.514.3000

PowerUp Lending Program FAQ:

Q: What is the PowerUp Lending Program?

A: Go Energy Credit Union (formerly GEMC Credit Union) loans money to help you install energy efficiency improvements in your home. Go Energy Credit Union has been serving employees of Georgia's EMCs for over 50 years and is federally insured by the National Credit Union Association. The PowerUp loan is not administered or serviced by Mitchell EMC. You will need to contact Go Energy Credit Union to apply and for all questions and assistance.

Q: Who can qualify?

A: Any existing homeowner receiving electrical service from Mitchell EMC who has a good credit score and payment history with the cooperative is eligible to apply for the loan. The home must be located in the state of Georgia. Loan qualification is subject to assessment of individual creditworthiness and our underwriting standards. All credit union loan programs, rates, forms, and conditions are subject to change at any time without notice. Please speak to your Go Energy Credit Union loan representative for available term options.

Q: How can I use the PowerUp loan?

A: The PowerUp loan can be used for the purchase and installation of the following types of equipment in existing homes:

- Central heat pumps and air conditioners

- Heat pump water heaters

- Solar water heating systems with electric back up

- Replacement windows, roofs, and appliances

- Whole-house backup generators

All of these items are required to be ENERGY STAR rated for energy savings. Gas furnaces are eligible if combined with a heat pump or air conditioner installation. The furnace must also be ENERGY STAR rated unless installed as an auxiliary heater for a dual fuel heat pump system. Additional eligible improvements include Marathon water heaters, ductwork and other HVAC related items as well as insulation and other weatherization products. Loan items requested, but not listed above, will need prior approval.

Q: How much can I finance?

A: The loan is limited to the actual cost of the equipment, supplies and installation.

Q: What is the interest rate?

A: The interest rate for all loans is 9.9 annual percentage rate. This rate has been discounted by one percent for payment by automated bank draft.

Q: How is the loan secured?

A: Loans are secured by signature.

Q: Are there any loan origination fees?

A: Closing cost is $65.

Q: What is the length of payments?

| Loan Amount Maximum Length of Payments |

Months |

| $500 to $3,000 | 36 |

| $3,001 to $7,500 | 36 to 60 |

| $7,501 to $25,000 | 61 to 96 |

Q: How do I select a contractor?

A: You select your own contractors. Your contractor will have to meet certain business criteria, supply business information and ENERGY STAR certification on improvements made to your residence before beginning work.

Q: What if multiple contractors are involved in the project?

A: You will need to obtain all of their bids to determine the total amount you wish to borrow. For example, if you need $5,000 for a HVAC system, $4,000 for windows, and $1,000 for insulation, you apply for the total amount needed ($10,000) before moving forward with the project.

Q: How do I apply for a PowerUp loan?

A: After you decide on the improvements and the total amount you need to borrow, apply directly to Go Energy Credit Union here. Loans are generally approved by Go Energy Credit Union within 24 to 48 hours upon receiving the completed application.

Q: How will I be notified of approval?

A: You will be notified by phone by a representative of Go Energy Credit Union. When your loan is approved and closed, you will become a member of Go Energy Credit Union and will be able to take advantage of their full line of financial services. Do not proceed with work until you and your contractor are approved.

Q: How do I get paid?

A: Go Energy Credit Union issues check(s) to the customer at the time of closing. The check is made payable to you and your contractor(s). If multiple contractors are involved in the project, checks will be issued to each participating contractor. The customer is responsible for giving the check to the participating contractor(s).